The Leverage Trap: Decoding the Deadly Equation of “Leverage + One-Way Market + Continuous Averaging Down”

In March 2023, during a sharp Bitcoin downturn, data from a major crypto exchange revealed a brutal statistic: 93% of accounts using 20x leverage were liquidated. This confirms a harsh financial reality—when high leverage meets a one-way market, combined with irrational averaging-down strategies, disaster is inevitable. This deadly combination forms a financial “wealth grinder,” relentlessly wiping out traders who underestimate risk.

This is not a coincidence; it is a recurring pattern in financial markets—Big Losses = Leverage + One-Way Market + Continuous Averaging Down. Each of these factors amplifies risk, and when combined, they create a compounding effect that can wipe out an entire account in hours.

1. The Lure of Leverage: How a Wealth Amplifier Becomes a Loss Accelerator

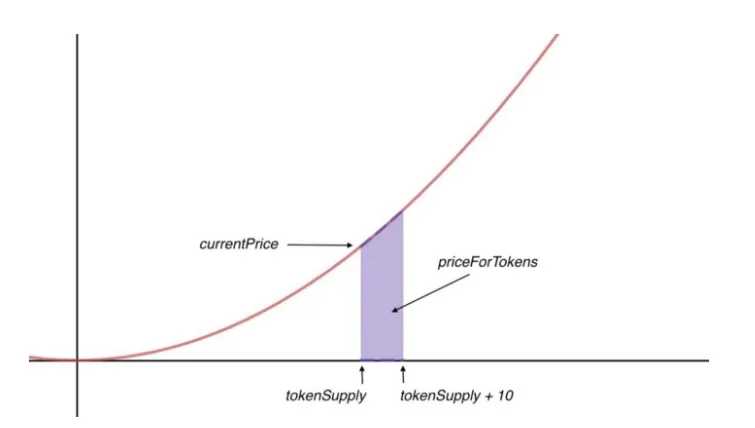

Leverage trading is essentially borrowing money to invest. Some exchanges offer leverage up to 125x, meaning a trader can control a $100,000 position with just $800. In a choppy market, this leverage can produce staggering gains, fueling stories of traders turning small accounts into fortunes.

For example, one trader reportedly turned $10,000 into $270,000 in just three months using 5x leverage. Such success stories spread like wildfire in trading communities, making leverage seem like a shortcut to financial freedom.

But leverage cuts both ways. In the 2020 “Oil Futures Crisis,” retail investors not only lost all their capital but ended up owing their brokers massive debts. Data from the Chicago Mercantile Exchange (CME) shows that in a one-way market, accounts using 10x leverage survive for an average of just 72 hours. Even more alarming, each additional leverage multiple increases the probability of liquidation by 47%.

The most dangerous aspect of leverage is that the market won’t give you time to react. When prices move against you and margin requirements aren’t met, the exchange’s automated liquidation system executes a forced sell-off within 0.3 seconds, wiping out entire accounts before traders can even react.

2. The Death Spiral of a One-Way Market

A one-way market is characterized by a continuous price breakout, soaring volatility (VIX), and evaporating liquidity. When this happens, traditional risk management strategies collapse.

Take, for example, the 2022 British pound flash crash—within just two minutes during Asian market hours, GBP/USD plummeted by 6.1%, wiping out over 2,000 forex accounts. The reasons why these markets are so lethal include:

- Self-reinforcing panic. When the Fear & Greed Index hits extreme levels, automated trading algorithms trigger cascading stop-losses, creating a domino effect that accelerates price movements.

- Liquidity dries up, leaving traders stranded. In extreme market conditions, order book depth can shrink from tens of thousands of contracts to fewer than a hundred, making it nearly impossible to execute trades.

- Technical analysis completely fails. Research shows that during one-way market movements, indicators like Bollinger Bands, MACD, and Fibonacci retracements drop from their usual 68% accuracy to just 12%.

Many traders wrongly believe that what goes down must bounce back, but in extreme conditions, prices can continue moving in the same direction far beyond what most imagine. This is exactly where overleveraged traders get trapped.

3. The Averaging Down Trap: The Psychology of Sunk Cost Fallacy

“I’ll just buy more and lower my average cost—markets always rebound, right?” This is the most common thought process among leveraged traders. The reality? Averaging down usually just magnifies losses.

Behavioral finance studies show that when traders lose 20% of their capital, 83% of them will attempt to average down. This is driven by the brain’s loss aversion mechanism, which pushes people into riskier behavior in an attempt to “recover” losses.

One infamous example is the 2022 Nickel Market Squeeze. A commodities trader initially opened a small short position, but as nickel prices surged, he doubled down with each 5% increase. By the 7th averaging-down trade, his leverage had hit the ceiling, resulting in a single-day loss of 37x his initial capital.

Quantitative research shows that in a downtrend, the success rate of averaging down is less than 18%. When prices deviate more than three standard deviations from the 20-day moving average, the expected return on an averaging-down strategy is -247%. To make matters worse, algorithms detect this behavior and often trigger “fake rebounds” to bait traders into buying more before resuming the trend, further reducing success rates by 42%.

Conclusion: The Best Traders Know When to Walk Away

The combination of leverage, a one-way market, and averaging down is a lethal financial trap, designed to wipe out traders with poor risk management. As legendary investor Ray Dalio outlines in his “All-Weather Strategy”:

- Keep leverage below 1.5x to minimize forced liquidation risks.

- Set dynamic stop-loss levels and stick to them—never gamble on price reversals.

- Avoid averaging down in a downtrend—instead, wait for market conditions to shift.

Great traders don’t fight the storm—they survive it. The financial markets are not a game you must win, but they are full of pitfalls you must avoid. And the most dangerous among them? High leverage, one-way markets, and the temptation to double down.