Introduction

Welcome to our comprehensive guide designed to help you transition from centralized exchange (CEX) trading to the exciting world of on-chain memecoin trading. This guide draws insights from experienced traders like @0xcryptowizard on X and provides beginners with essential steps, strategies, and risk management techniques needed to navigate this dynamic landscape.

Why Learn On-Chain Trading?

The cryptocurrency market often exhibits a barbell structure, with established assets like Bitcoin (BTC) and Solana (SOL) at one end, and a long tail of memecoins at the other, offering significant wealth-generating opportunities. Mid-tier altcoins, due to their “dump-on-listing” nature, often prove more challenging to trade profitably. Engaging in on-chain trading offers several advantages:

- Explosive Growth Potential: On platforms like Solana, “golden dog” projects can emerge weekly, experiencing rapid price appreciation. On-chain assets can have the potential to reach a ceiling of 1 Billion, therefore creating a long term investment oppotunity.

- Exposure to New Trends: From the DeFi summer to the rise of AI agents, on-chain activity introduces new wealth effects and trends. Staying ahead of these trends is crucial for maintaining a competitive edge in the market.

Can On-Chain Trading Really Make You Rich?

While numerous stories of overnight fortunes circulate, the risks associated with on-chain trading are substantial. Success typically requires:

- Significant Time Investment: Dedicate ample time to learning and understanding market dynamics.

- Gradual Progression: Start with small capital to experiment and learn, gradually increasing investment as you gain experience and confidence.

- Risk Awareness: Only increase your investment after thoroughly understanding the inherent risks.

Getting Started with On-Chain Trading on Solana

Here’s a step-by-step guide to begin your on-chain trading journey within the Solana ecosystem:

- Setup: It’s recommended to use a computer for on-chain trading. The complexity and volume of information involved, including on-chain data, community sentiment, and trending assets, far exceed what’s typically analyzed in CEX trading.

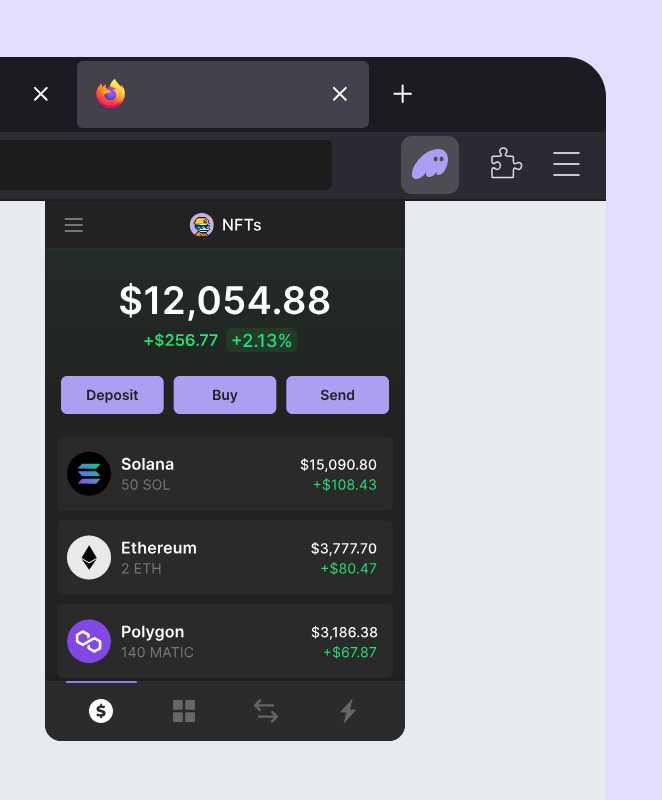

- Wallet Setup: For Solana, the Phantom wallet is highly recommended. Install the Phantom wallet extension on your Chrome browser. Crucially, safeguard your seed phrase – it’s the key to your assets.

- Fund Your Wallet: Transfer SOL from a centralized exchange (CEX) to your Phantom wallet address.

- Finding trade targets: use a platform like Gmgnai to analyze the tokens and trade them. Be careful of scam links.

- Execute Your First Trade: Let’s use WIF as an example:

- Buying: Set your slippage to 0.5% (or higher during periods of high volatility). Enter the amount of SOL you want to spend (e.g., 0.1 SOL) and click “Buy.”

- Selling: Select 100% of your holdings and click “Sell.”

Key Concepts in On-Chain Trading

- Community Engagement: Participate in community activities on platforms like Telegram, such as “shilling” to boost a token’s visibility.

- Trending Tokens (Hot Tokens): Identify tokens that are experiencing rapid price increases due to events or endorsements, such as Pnut, which benefited from a mention by Elon Musk.

- Slippage: Understand the price difference you’re willing to accept during a trade. Adjust your slippage settings based on market conditions.

- MEV and Sandwich Attacks: Learn about Miner Extractable Value (MEV) and how to protect yourself from sandwich attacks by setting appropriate slippage and using trading platforms with MEV protection features.

- AMM Pools and LPs: Familiarize yourself with how Automated Market Maker (AMM) pools function. Your trades are executed against these liquidity pools, not directly with other traders.

- Rugpulls and Honeypots: Recognize the signs of a rugpull (liquidity drain) and avoid honeypots (tokens that can only be bought, not sold).

- Internal vs. External Markets: Understand the distinction between new tokens created on platforms like Pump.fun (internal market) and those that successfully migrate to decentralized exchanges like Raydium for broader trading (external market).

Finding Promising Tokens

To discover potentially profitable tokens:

- Social Media Monitoring: Scour social media platforms like X and Telegram for real-time information and insights. “Follow the chatter” to identify trending tokens.

- Wallet Tracking: Monitor the wallet addresses of successful traders to see what they’re investing in. Use tools to track smart money movements.

- Long-Term Observation: Keep an eye on tokens with steadily growing communities and trading volume. For tokens that have experienced a significant pullback after a pump, consider gradually accumulating a position.

Conclusion

This guide provides a comprehensive introduction to transitioning from CEX trading to the world of on-chain memecoin trading. While the potential for significant gains exists, it’s crucial to approach this space with caution, diligence, and a commitment to continuous learning. Stay tuned for our advanced guides, where we’ll delve deeper into advanced strategies and risk management techniques.