The world of cryptocurrency never ceases to amaze, constantly churning out new trends that capture the attention of investors and degens alike. The latest craze? Bonding meme coins. These tokens, powered by a unique economic model called a bonding curve, promise a dynamic and potentially lucrative investment opportunity, but they also come with inherent risks that require careful consideration.

This article will dive deep into the world of bonding meme coins, exploring what they are, how they work, and what you need to know before jumping on the bandwagon.

What is a Bonding Curve in Crypto? Understanding the Core Mechanism

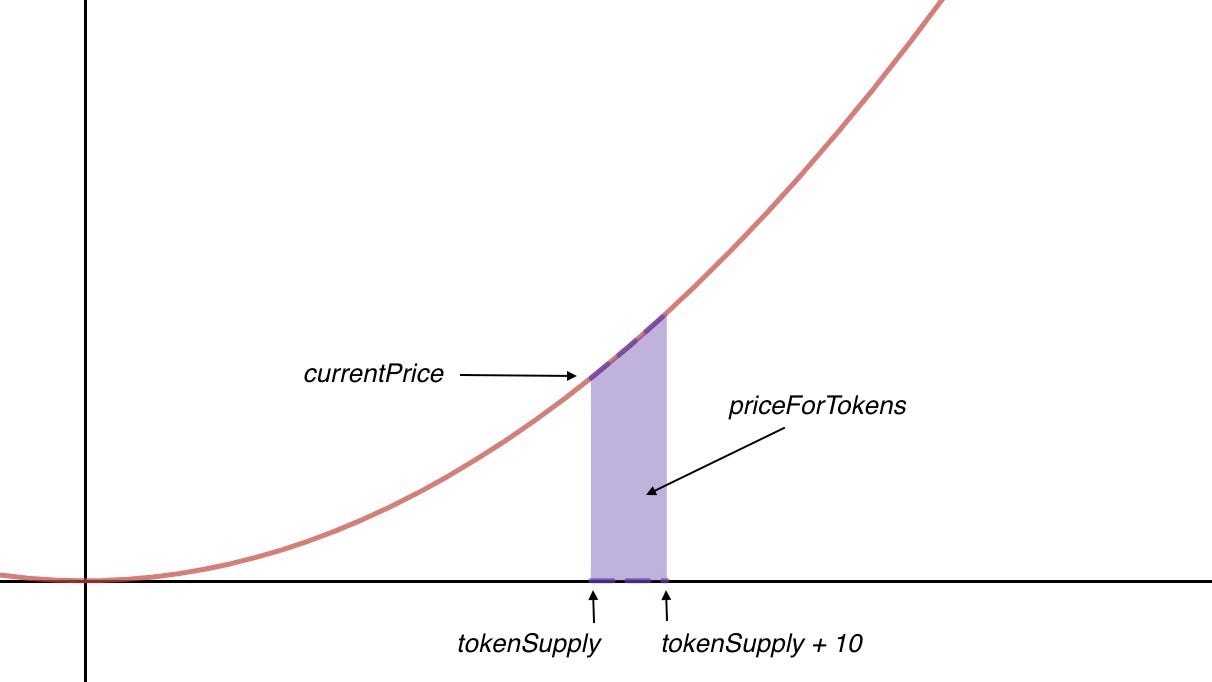

Before we get into bonding meme coins, let’s understand the fundamental concept of a bonding curve. In simple terms, a bonding curve is a mathematical formula implemented through a bonding curve smart contract that defines the relationship between a token’s price and its supply.

Here’s how it works:

- Token Price is Dynamic: Unlike traditional tokens where price is determined by market forces on exchanges, the bonding curve token price is algorithmically determined.

- Buy and Sell Directly: Users interact directly with the bonding curve smart contract to buy and sell tokens.

- Price Increases with Purchase: When you buy tokens, you mint them from the smart contract, increasing the supply and consequently pushing the price up along the curve.

- Price Decreases with Sale: When you sell tokens back to the contract, they are burned, decreasing the supply and causing the price to drop along the curve.

- The formula within the contract define the price of the token, for example, 1 token = x collateral, x is the amount of reserve. The bonding curve progression meaning that the price is determined by the formula and the amount of reserve (or supply, as the formula indicates)

Bonding Curve Solidity: Building the Foundation

Solidity is the programming language most commonly used to create smart contracts on the Ethereum blockchain (and EVM-compatible chains). Developers use Solidity to code the logic of the bonding curve, defining the mathematical formula that governs the token’s price and supply relationship. This code is then deployed as a bonding curve smart contract.

(Insert an image here showing a snippet of Solidity code for a simple bonding curve. You can find examples online, for instance, at https://github.com/lsaether/bonding-curves. Ensure you choose a simple and illustrative example.)

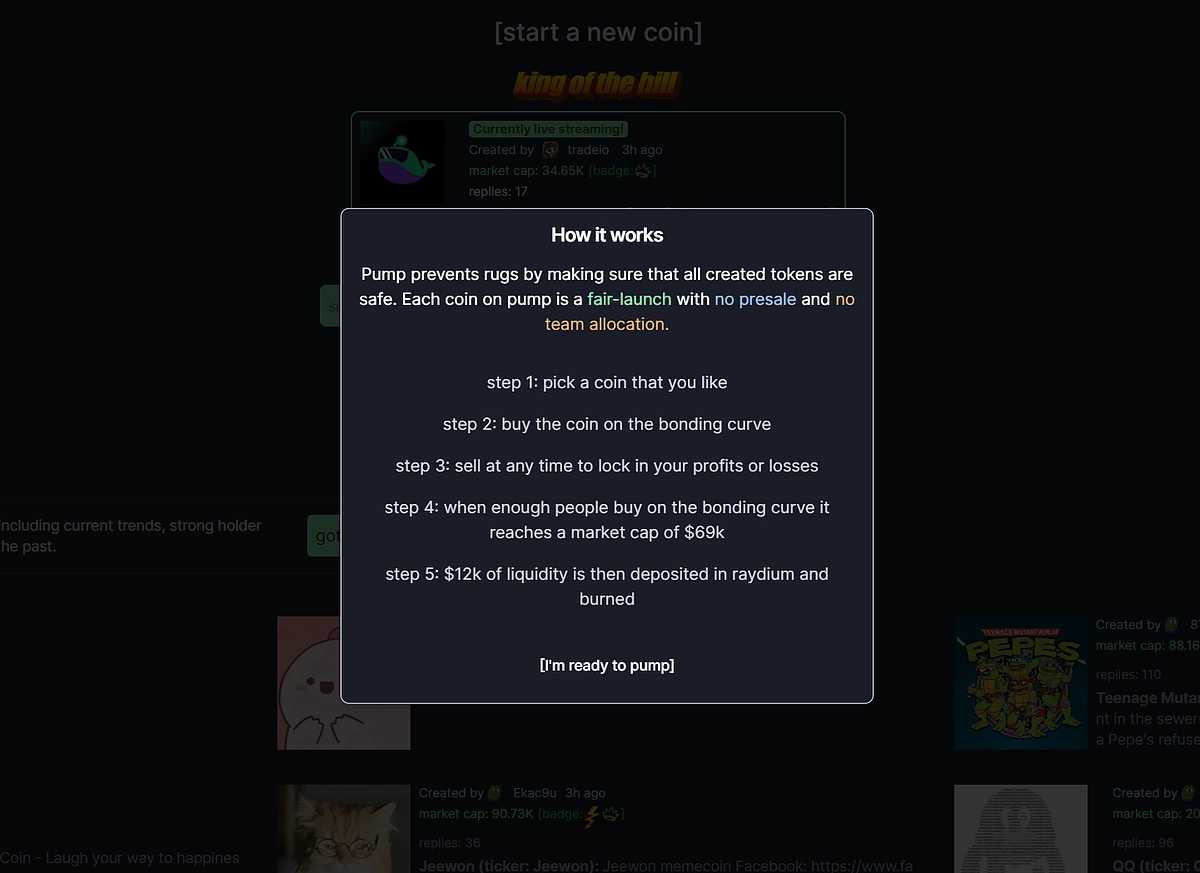

Bonding Curve Solana: Expanding Beyond Ethereum

While Ethereum was the initial birthplace of bonding curves, other blockchains are now embracing this model. Bonding curve Solana implementations are gaining traction due to Solana’s high throughput and low transaction fees. This makes Solana an attractive alternative for developers looking to deploy bonding curve tokens, especially for high-frequency trading scenarios common with meme coins.

Bonding Meme Coin: Adding the Hype Factor

Now, let’s add the “meme” element to the equation. Bonding meme coins are essentially tokens that leverage the bonding curve model but are also infused with the virality and community-driven nature of meme coins. Think of it as combining the innovative economics of bonding curves with the speculative frenzy of meme coins like Dogecoin or Shiba Inu.

Bonding Meme Coin Price: A Wild Ride

The bonding meme coin price is particularly volatile due to the combination of the bonding curve’s algorithmic price adjustments and the unpredictable nature of meme coin communities. Early adopters can potentially see significant gains as the price rises rapidly along the curve with increased demand. However, the opposite is also true: a sell-off can lead to a sharp price drop.

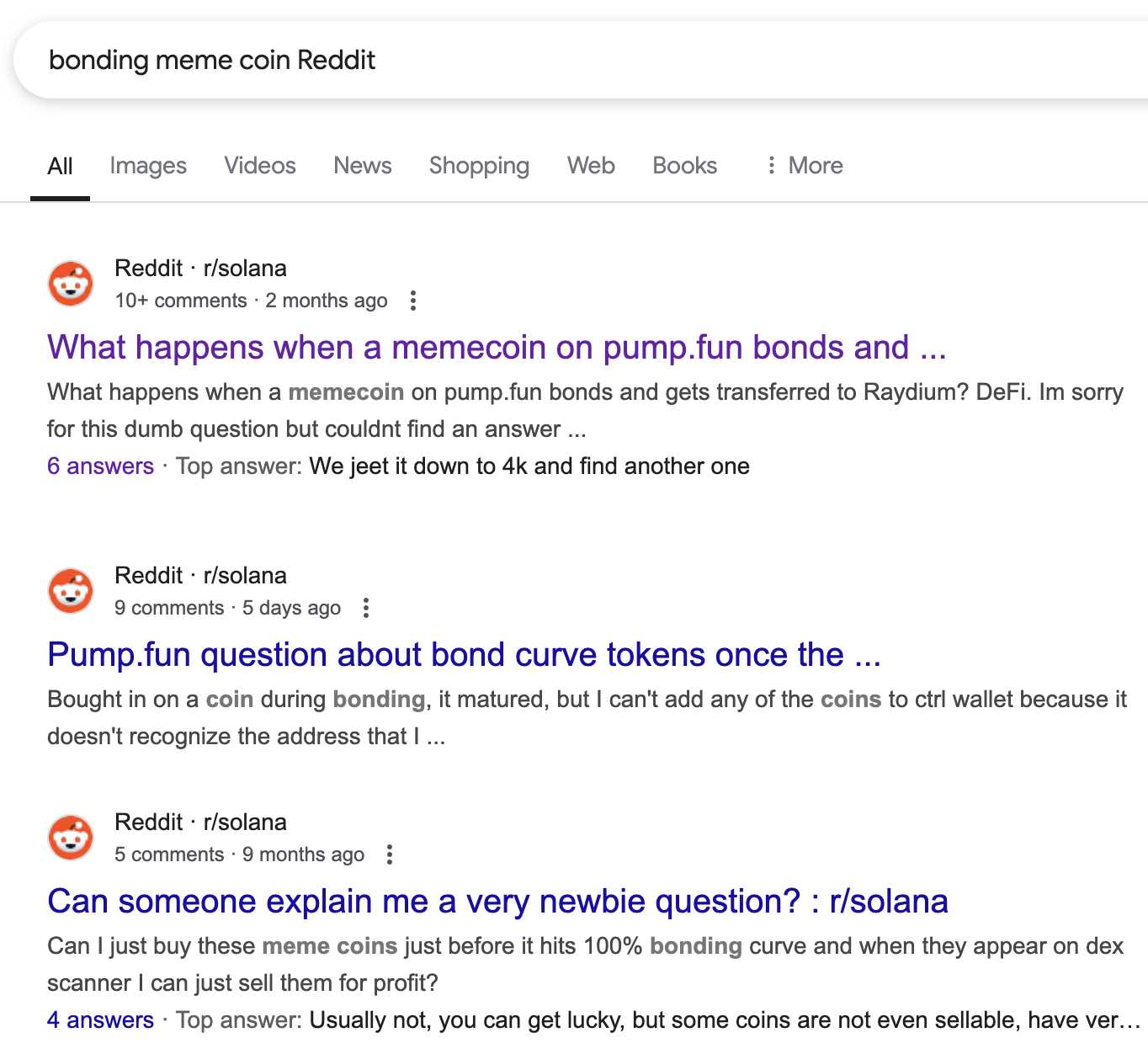

Bonding Meme Coin Reddit: The Community Hub

Like many crypto projects, bonding meme coin Reddit communities are often the central hubs for discussion, speculation, and updates. These subreddits are where potential investors can gauge community sentiment, learn about new projects, and participate in the meme coin culture. The social media channel X (Twitter) is also a place to find the latest trend. For example, there was a thread talking about the pump fun bonding curve, from @psyriiis.

The Risks and Rewards

Bonding curve progression meaning you could profit a lot or lose a lot. Bonding meme coins present a unique investment opportunity, but it’s crucial to acknowledge the risks:

- Volatility: The algorithmic price adjustments can lead to extreme price swings.

- Rug Pulls: Malicious developers can manipulate the bonding curve or abandon the project, leaving investors with worthless tokens.

- Speculative Nature: The meme coin aspect adds another layer of speculation, making it difficult to predict long-term value.

Conclusion: Proceed with Caution and DYOR

Bonding meme coins are an exciting development in the crypto space, offering a novel approach to tokenomics and community engagement. They could be highly profitable, or lose all your money. However, they are inherently risky. Before investing, do your own research (DYOR), understand the mechanics of bonding curves, and only invest what you can afford to lose. The world of bonding meme coins is a wild ride – buckle up, but be prepared for anything.