How Does Pump.fun Work? A Deep Dive into its Innovative Mechanics

Pump.fun has rapidly gained popularity in the cryptocurrency space by offering a streamlined and secure platform for memecoin creation and trading. But how does it actually work behind the scenes? Let’s explore the mechanics that make Pump.fun a game-changer in the world of decentralized finance (DeFi).

Simplifying Memecoin Creation for Everyone

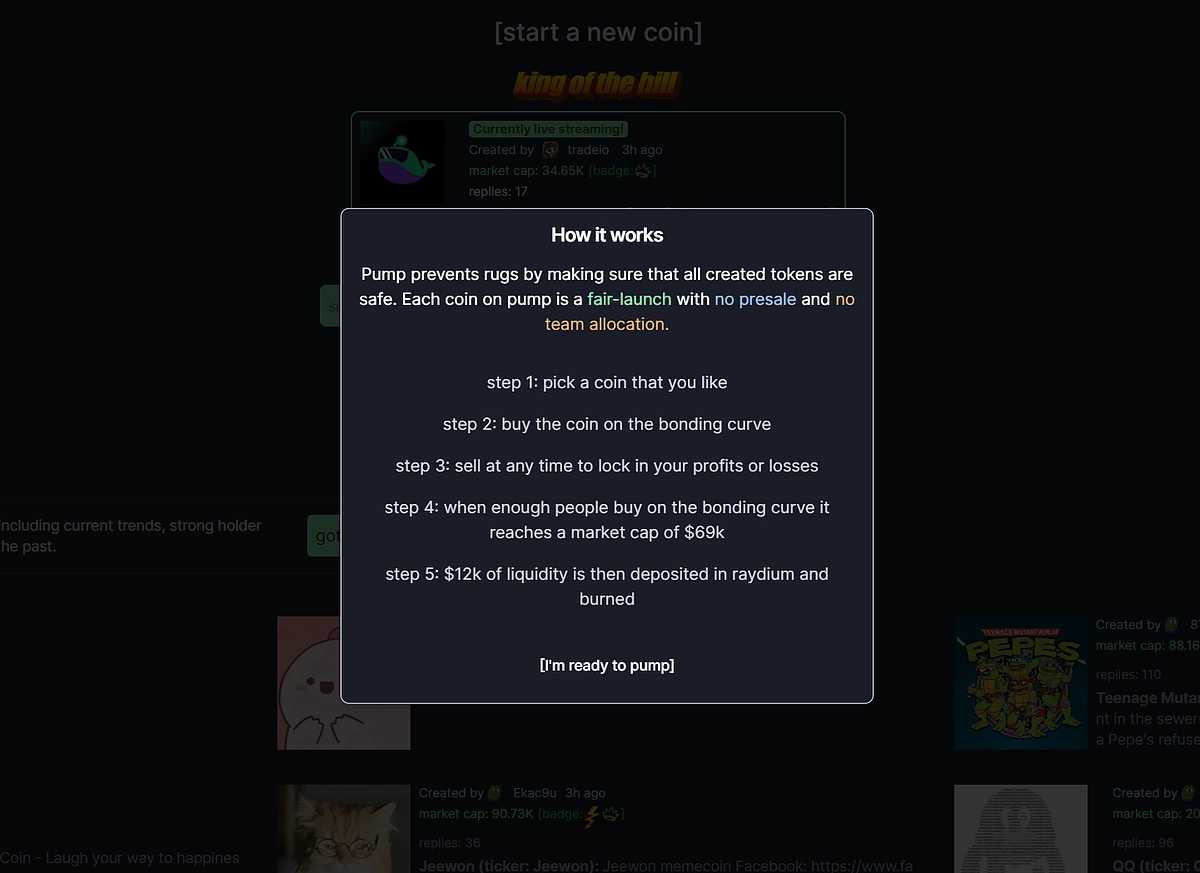

At its core, Pump.fun’s mission is to democratize memecoin creation. It achieves this by abstracting away the complex technical hurdles typically associated with launching a cryptocurrency. Users are greeted with a clean, intuitive interface that simplifies the entire process. Forget complicated code and intricate smart contracts; Pump.fun makes creating a memecoin as easy as filling out a few fields, as seen on its simple interface:

The Power of Fair Launches and Bonding Curves

Pump.fun is built on the principle of fair launches. Unlike traditional token launches that often involve pre-sales or private allocations, giving early investors an unfair advantage, Pump.fun ensures everyone has an equal opportunity. All participants acquire tokens at the same price, determined by the platform’s innovative use of bonding curves.

What are Bonding Curves and Why are They Important?

A bonding curve is a mathematical concept that defines a relationship between a token’s price and its supply. On Pump.fun, each memecoin is tied to a unique bonding curve. This curve automatically adjusts the token’s price based on buying and selling activity:

- Buying Pressure: When users buy a token, they move along the curve, increasing the price.

- Selling Pressure: Conversely, when users sell, they move down the curve, decreasing the price.

This dynamic pricing mechanism is crucial for several reasons:

- Transparency: The price is determined algorithmically and publicly visible on the curve.

- Liquidity: The bonding curve itself acts as the liquidity pool, eliminating the need for creators to manage it separately.

- Rug Pull Mitigation: Since creators don’t control a separate liquidity pool, they can’t drain it and abscond with investor funds, a common scam known as a “rug pull.”

The Road to Raydium: Automated DEX Listing and Liquidity Burning

Pump.fun’s commitment to a secure and thriving memecoin ecosystem extends beyond the bonding curve. A key milestone for any token launched on the platform is reaching a market capitalization of $69,000. This triggers a significant event:

- Automated Liquidity Deposit: Once the $69,000 threshold is met, Pump.fun automatically deposits $12,000 worth of SOL liquidity, along with a corresponding amount of the memecoin, onto Raydium, a leading decentralized exchange (DEX) on the Solana blockchain.

- Liquidity Burning: To further solidify the token’s presence on Raydium and prevent any manipulation, the liquidity provider (LP) tokens received from this deposit are permanently burned. This effectively locks the liquidity on Raydium, ensuring it cannot be removed.

- Creator Incentive: The creator of the memecoin is also rewarded with 0.5 SOL when this milestone is hit, a small incentive to reward them for building a successful project on the platform.

Why is this important? This automated process transitions the memecoin from Pump.fun’s bonding curve environment to a broader, more established trading venue (Raydium). It provides increased liquidity, visibility, and legitimacy for the token. The burning of LP tokens removes any lingering concerns about the creator’s ability to manipulate the liquidity pool. This method is also designed to manage token supply and potentially bump up the memecoin’s price as a reward for hitting this milestone.

In Summary: A Secure and Transparent Ecosystem

Pump.fun’s innovative use of bonding curves, fair launches, and automated DEX listing creates a more secure, transparent, and user-friendly environment for memecoin creation and trading. By removing technical barriers and mitigating common risks, Pump.fun empowers a wider range of users to participate in the exciting, albeit volatile, world of memecoins.