Introduction

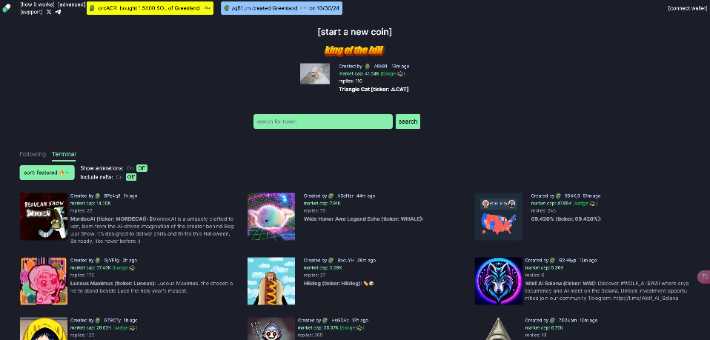

Pump.fun is a popular platform in the cryptocurrency space that allows users to create and launch their own memecoins quickly and easily. Launched in early 2024, pump.fun has rapidly gained traction due to its user-friendly interface, low cost of entry, and innovative approach to token launches. This platform has become a hub for memecoin enthusiasts, providing a space for both creators and traders to engage in the volatile yet exciting world of memecoins.

What is Pump.fun?

Pump.fun is a website and platform on the Solana blockchain designed to facilitate the creation and trading of memecoins. It allows users to deploy new tokens with minimal capital and technical knowledge. The platform simplifies the token creation process, making it accessible even to those with no coding experience. Unlike traditional token launches that require significant resources and liquidity, pump.fun enables users to create a token for less than $2.

Key Features of Pump.fun

- Ease of Token Creation: Pump.fun allows users to create a memecoin in just a few clicks, without needing to write any code.

- Low Cost: Deploying a token on pump.fun costs less than $2, making it accessible to a wide range of users.

-

Fair Launch Mechanism: The platform uses a bonding curve model to ensure a fair launch, preventing rug pulls and ensuring that all investors have an equal opportunity to participate.

-

Automated Liquidity Provision: Once a token’s market cap reaches a certain threshold, liquidity is automatically deposited to a decentralized exchange (DEX), such as Raydium, and the liquidity pool (LP) tokens are burned.

-

Safety and Security: Pump.fun’s bonding curve model eliminates the risk of instant rug pulls, as the creator cannot withdraw funds before the token reaches a specific market cap and liquidity is deposited to a DEX.

-

Community Engagement: The platform fosters a vibrant community of memecoin creators and traders, providing a space for interaction and collaboration.

How Does Pump.fun Work?

Pump.fun operates on a unique model that combines ease of token creation with a fair and secure launch mechanism. Here’s a breakdown of how it works:

- Token Creation: Users can create a token by providing a name, ticker, description, and image. The platform handles the technical aspects of token deployment.

-

Bonding Curve: Each token is launched on a bonding curve, which is a mathematical curve that determines the token’s price based on its supply. Users buy and sell tokens directly from this curve.

-

Fair Launch: All tokens have the same bonding curve parameters, ensuring that every investor has the same opportunity. There are no pre-sales or team allocations.

-

Liquidity Migration: When a token’s market cap reaches $69k, $12k of SOL and the tokens are deposited to Raydium, a Solana-based DEX. The LP tokens are burned, preventing the creator from withdrawing the liquidity.

-

Trading: Once on Raydium, the token can be traded like any other cryptocurrency.

Step-by-Step Guide to Creating a Memecoin on Pump.fun

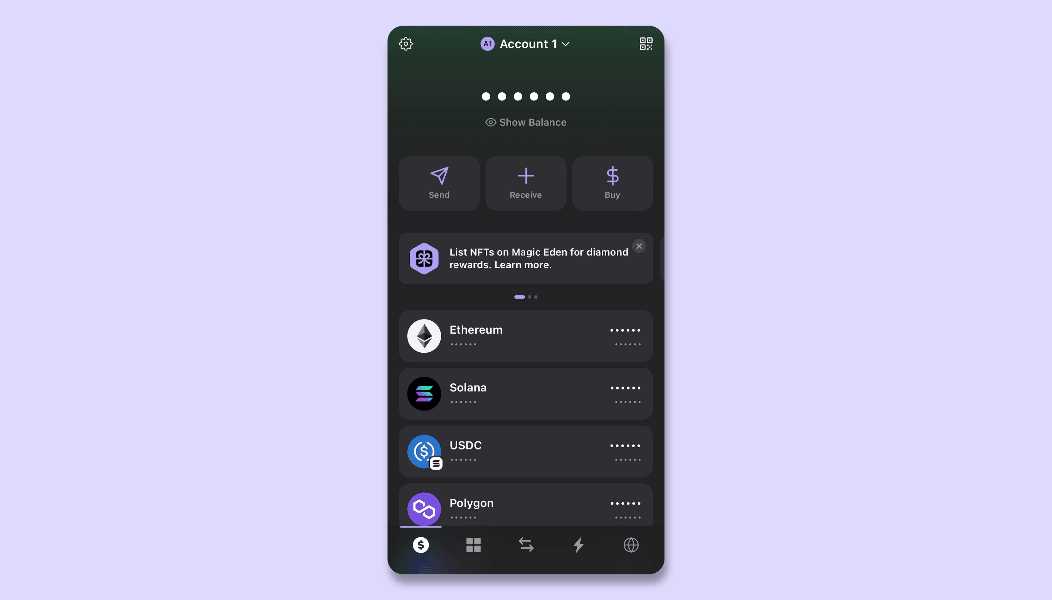

- Connect Your Wallet: Go to the pump.fun website and connect a Solana-compatible wallet, such as Phantom or Solflare.

-

Design Your Token:

- Enter the token’s name and ticker.

-

Write a brief description.

-

Upload an image for the token.

- Launch Your Token:

-

Review the token details.

-

Pay the small fee (less than $2) to deploy the token.

-

Promote Your Token: Share your token with the community to attract buyers and increase its market cap.

-

Reach Liquidity Migration: Once the market cap reaches the threshold, the liquidity will be automatically deposited to Raydium, and your token will be tradable on the DEX.

Benefits of Using Pump.fun

- Accessibility: Anyone can launch a token, regardless of technical expertise or financial resources.

-

Affordability: Low cost of entry makes it appealing to a broad audience.

-

Transparency: The bonding curve model ensures a fair and transparent launch process.

-

Security: Built-in safety features minimize the risk of scams and rug pulls.

-

Community: Pump.fun provides a platform for creators and traders to connect and build a community around memecoins.

Risks and Considerations

- Volatility: Memecoins are highly volatile, and their value can fluctuate dramatically.

-

Competition: The platform is crowded, making it challenging to stand out and attract buyers.

-

Regulatory Uncertainty: The regulatory landscape for memecoins is still evolving, and future regulations could impact the platform.

-

Market Saturation: The ease of token creation has led to a large number of memecoins, many of which fail to gain traction.

Conclusion

Pump.fun has revolutionized the memecoin space by providing an accessible, affordable, and secure platform for token creation and trading. Its unique bonding curve model and fair launch mechanism have made it a popular choice for both creators and investors. While the memecoin market remains volatile and unpredictable, pump.fun offers a transparent and community-driven approach to participating in this exciting new frontier of cryptocurrency. Whether you’re a seasoned crypto enthusiast or a newcomer curious about memecoins, pump.fun provides a user-friendly gateway to explore this dynamic and rapidly evolving ecosystem.