Whenever you think the market is dull, there’s always a new golden dog that catches your eye.

This morning at 9:00, a new AI Agent token called $AGIXT appeared, and in less than two short hours, its market cap quickly reached $80 million; even more exaggerated is that the trading volume during this period reached $96 million, showing a long-lost market activity.

While everyone was slow to react, in contrast, within half an hour of the token launch, on-chain data showed that a large amount of smart money quickly bought AGIXT, and there was no shortage of whales with single transactions exceeding 50 SOL.

What exactly is this AGIXT, and how is it different from other AI Agent tokens? We took a look at its Github and more introductions to give you a quick understanding of AGIXT.

2700 Stars, an AI Automation Framework

Sometimes, people don’t really care about the technical details of an AI Agent token. What they care about is whether there are any clues that make the project “look good”.

With this mindset, the number of stars on Github has gradually become a marketing point for AI Agent tokens — the more stars, the more developer recognition, and the more it highlights the project’s technical influence and strength.

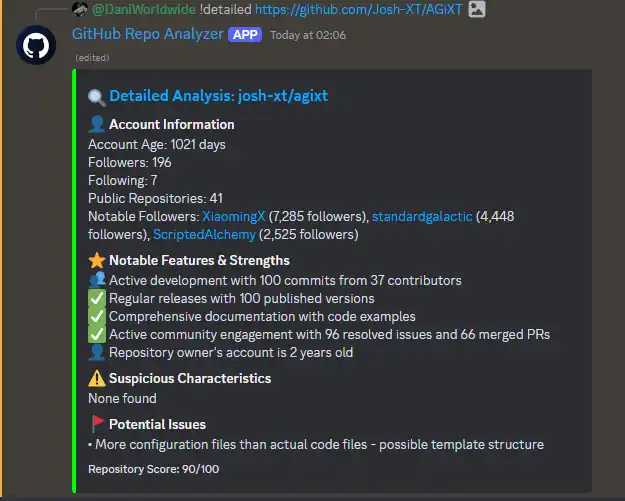

Browsing the AGIXT code repository, you can find that the project has more than 2,700 stars, which is indeed better than a project that relies on empty stories and randomly creates a Github repository.

More importantly, these stars weren’t recently acquired.

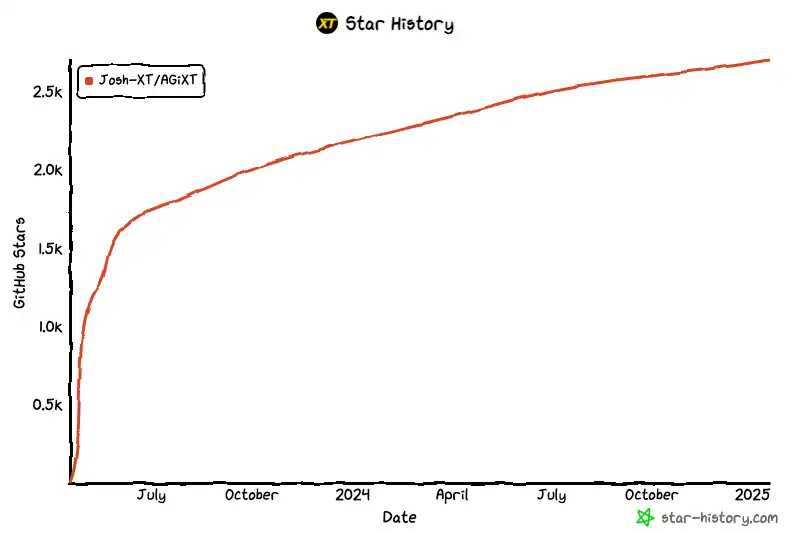

As you can see from the Star History below, the project was launched early last year, and since July 2023, the number of GitHub stars has shown a steady upward trend.

If it was just for show, the layout would be too long, even earlier than when the whole AI Agent narrative started. Therefore, it is more like an off-circle project that has been working all along, trying to tokenize in this wave of enthusiasm and then be discovered for its value.

But what exactly does this AGIXT do?

According to the official description of the code repository, AGIXT is essentially an AI automation platform, simply put, it is a tool that allows AI to automatically complete more complex tasks. Its biggest feature is that it can call multiple AI models (such as OpenAI, Claude, etc.) to work together , just like equipping you with a team of AI assistants.

This sounds more like something for developers, but what can you do with this platform?

For end users, you can make natural language requests to tools built with the platform’s API and get actionable results. In layman’s terms, you can use normal language to have a conversation with AI and get answers in different task scenarios.

This sounds similar to what the current popular frameworks do, but this project has several attractive highlights:

Multitasking capabilities: It can not only handle simple conversations, but also automatically plan task steps, search for information online, execute commands, and even interact through voice —— it can be understood as a super-enhanced version of ChatGPT.

Good memory: The platform has a built-in intelligent memory system that allows AI to maintain the context of long-term conversations like humans, without “forgetting”.

Highly scalable: With the plugin system, developers can easily add new features to AGIXT.

Comprehensive compatibility: It supports current mainstream AI models, including OpenAI, Hugging Face, etc., and users can freely switch between different AI services according to their needs.

From a technical point of view, AGIXT’s design is quite complete, not only providing a Docker quick deployment solution, but also equipped with an API interface for other applications to call. This means that it can not only run independently, but also be easily integrated into other systems.

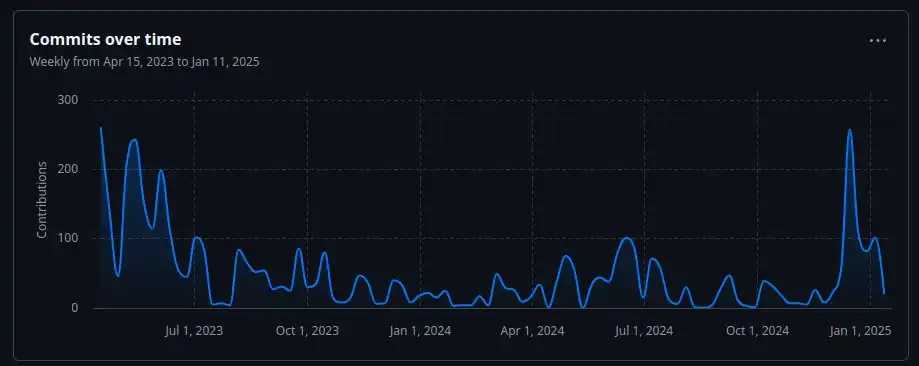

In addition, the project update frequency is also very online, with updates every month in the past year, unlike a token with only an empty shell.

From a narrative perspective, this is more like a framework or platform project. It is not a standalone application itself, and other projects can use its capabilities to make more AI Agents.

However, the actual effect of the Agent made with AGIXT needs to be tested with more use cases; it can only be said that the existing information presented by the project Github is not bad.

Not a Crypto Developer, but Focused on AGI Open Source Contribution

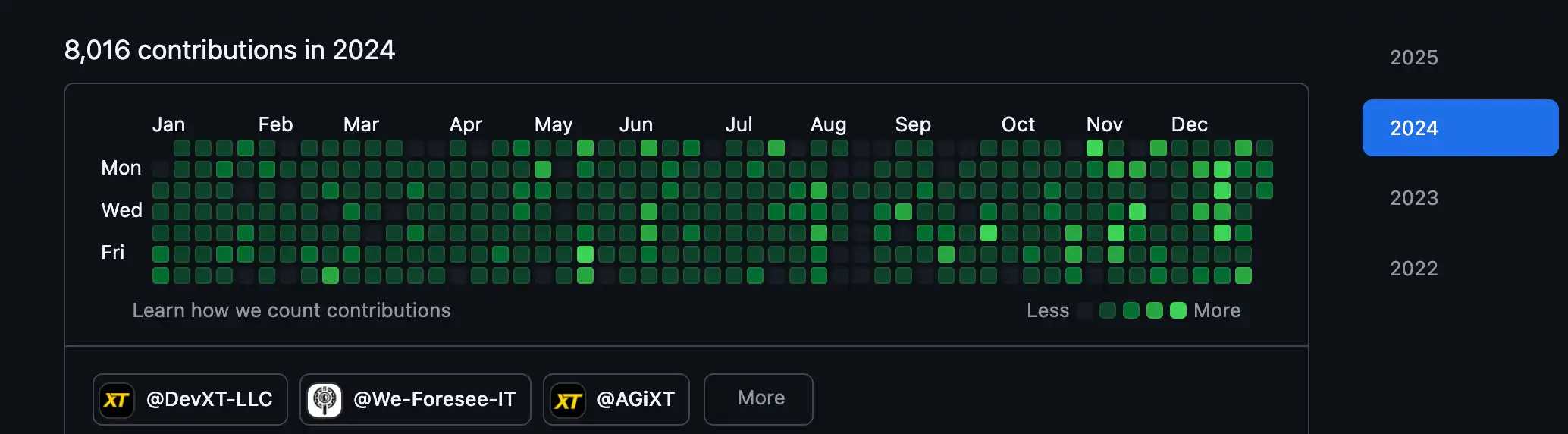

Associated information shows that the developer of the AGIXT project is @Josh_XT, who is passionate about continuous contribution to the AI open source field and submitted 8,000 code contributions on Github last year.

Some netizens said (unconfirmed news) that the dev’s contribution can be ranked in the top 2% of all developers on Github.

Three hours ago, Josh said in a tweet that he “hasn’t really set foot in the cryptocurrency field yet”, but believes that encryption does provide a lot of good support for the open source community.

At the same time, Josh also started trying to lock AGIXT tokens.

Public data shows that he is using Streamflow Finance to lock 5% (about 22.5M tokens) of the total 450M AGIXT tokens for a linear release period of two years, starting from January 16, 2025, with automatic unlocking every two weeks until the end of January 28, 2027.

For more introduction of the project team, please click here.

More Data Worth Noting

With seemingly good technology and a strong developer, AGIXT appears to be a bit “solid” among a bunch of playful projects.

But is this a reason to FOMO? Here is a summary of various information, you may wish to look at more data before making a decision.

Early KOLs are dumping

When the market value of AGIXT quickly rose to more than 50M, it can be found that there are more and more discussions on social media; but at the same time, some sharp-eyed netizens have found through data monitoring websites that some early KOLs are gradually selling to lock in profits.

Lockup questionable

Some tweeters also pointed out that although the developers are locking tokens, since the cliff is set to 0, it means that the developers can start getting unlocked tokens from day one, and there is no mandatory initial lockup period to protect investors.

This is a risk signal, worrying that developers may use this setting for improper operations, and warning that a price crash may occur.

Top holdings are too concentrated

Through the “chip analysis” function that comes with GMGN, you can see that the address HNFC…Sf4G holds 42.83% of the tokens.

According to the total value of $2.2M shown in the figure, this address holds about 71.65M tokens. It can be seen that the token distribution is very concentrated. The largest holder occupies nearly half of the total tokens, and the top few holding addresses together control more than 50% of the tokens.

However, the concentration of chips does not necessarily mean a crash, it may just mean that the price influence of the top holders will increase. It is also necessary to see whether the top holders have locked their positions or split their positions.

Overall, AGIXT is an AI framework with solid code and a strong developer, but within 3 hours of the token launch, the public information that can be seen is limited to this.

Whether it is a one-day golden dog or a rising star, the answer may only be seen after fierce PVP games and more information is released.